Seasonal Accounting Staff: Your Secret Weapon for Tax Season, Audits, and Beyond

From small businesses to large corporations, accounting and finance professionals all face those inevitable stretches when the numbers multiply faster than the people managing them. Deadlines loom, work piles up, and accounting teams are left in a blur of spreadsheets and late nights, with the coffee pot taking the crown as the office MVP.

During these high-pressure months, even the most capable teams can feel the strain. Long hours stack up, stress levels rise, and the risk of errors or burnout creeps in right when precision matters most. Instead of asking your core staff to push harder, why not give them the backup they deserve? Hiring seasonal accounting staff adds the flexibility, expertise, and breathing room your business needs to keep performance—and morale—intact.

With a little foresight and the right staffing partner, those chaotic accounting peaks can become manageable, predictable, and even (dare we say) organized. In this article, we’ll look at why workloads spike, what happens when teams are stretched too thin, how temporary professionals can bring relief, and how to plan ahead for a smoother, more productive busy season.

The Seasonal Pressures That Strain Accounting Teams

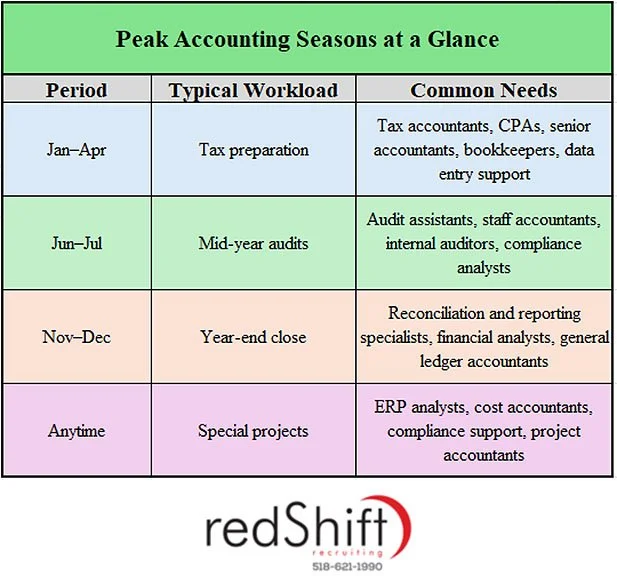

Every accounting team faces predictable peak periods. These cycles test efficiency, accuracy, and endurance across every level of the organization—and can quickly max out resources without proper support. Whether it's tax season, year-end close activities, audits, or large-scale financial projects, surges can hit at different times.

Tax Season: For many American accounting professionals, January to April is the most intense stretch of the year. With changing tax laws and complex filings making tax preparation a time-sensitive and detail-driven challenge, accountants must organize financial records and make sure taxes are filed quickly and accurately—on top of maintaining regular financial operations.

Year-End & Periodic Reporting: Annual and quarterly reporting bring another wave of deadlines as reconciliations, consolidations, and financial reporting needs intensify. Accounting teams may work overtime to prepare income statements, finalize financial data, verify supporting schedules, and ensure compliance with reporting standards.

Audits (Internal & External): Audits often introduce a rush of documentation requests, data verification, and review procedures, demanding strong knowledge of current regulations, documentation standards, and compliance frameworks. Accounting and finance staff must juggle details from across departments, and even minor oversights can trigger financial liability or compliance issues. In public accounting, these pressures are often amplified, as firms balance multiple client engagements and strict external deadlines simultaneously.

Special Projects & System Upgrades: Beyond these predictable, seasonal needs, businesses often face a variety of unique challenges such as ERP system upgrades, mergers, new compliance initiatives, or other large-scale process improvements. These projects can quickly stretch accountants thin, requiring specialized expertise and cross-functional coordination to stay on schedule and in compliance.

Even with modern accounting software increasingly able to automate data entry and simplify reporting procedures, human expertise is still required for oversight, data interpretation, and strategic decision-making. Skilled professionals ensure compliance, insight, and control—not just for the finance department, but also for payroll, HR, and operations teams that depend on timely communication and accurate data for a wide range of business needs.

The Real Cost of Understaffing During Peak Periods

During these periods when workloads spike, many companies try to “push through” with existing staff. It may seem efficient in the moment, but the hidden costs can add up quickly. Understaffing during busy times can affect everything from team morale to long-term financial health and client trust. The risks include:

Burnout & Turnover: Exhausted accounting professionals are more likely to make mistakes, overlook important details, and struggle to keep up with growing workloads. Over time, stress turns into disengagement—and eventually, your most reliable employees start looking for the exit. Burnout not only drains productivity but also disrupts continuity and adds recruiting costs when replacements are needed.

Reduced Productivity & Accuracy: When the focus shifts from strategy to survival, accuracy drops. Errors in reconciling bank statements, compiling financial reports, reviewing journal entries, or submitting tax returns can ripple into compliance problems and reporting delays. Furthermore, understaffing also increases the risk of audit findings or compliance penalties when mistakes slip through unnoticed.

Rising Overtime Costs: Overtime may seem cheaper than hiring temporary help, but those hours—and the fatigue they bring—can quickly exceed the cost of short-term staffing. Constant overtime also impacts team morale and overall productivity, increasing the risk of burnout and mistakes made under pressure.

Client & Stakeholder Impact: Delays, inaccuracies, or missed deadlines can erode clients’ trust and damage a company’s reputation. Even minor mistakes can have outsized consequences, snowballing into costly delays, compliance issues, and damaged relationships with clients and stakeholders.

Cash Flow Strain: When projects lag or invoices go out late, delayed receivables can tighten cash flow, disrupting financial planning and reducing your ability to make informed decisions or achieve key business goals. Persistent cash flow gaps can also limit growth opportunities or force short-term trade-offs that weaken long-term stability.

Costly Adjustments Later: Teams that rush now often pay for it later, spending additional time and money correcting errors that could have been avoided with adequate staffing. The rework doesn’t just waste hours—it disrupts momentum, delays reporting cycles, and drains resources from higher-value initiatives.

These ripple effects reach far beyond accounting. Access to timely, accurate financial data is critical for managers across departments to make informed decisions and keep the business running smoothly. The hidden cost is opportunity—teams too busy managing today’s crises can’t focus on forecasting, growth, or innovation.

Why Seasonal Accounting Staff Are a Strategic Advantage

Seasonal accounting professionals offer more than short-term relief to overwhelmed teams—they bring targeted expertise, flexibility, and fresh energy to help maintain performance and protect long-term goals. Here’s why bringing on seasonal accounting staff can be one of the smartest ways to manage peak workloads:

Instant Expertise

Pre-vetted accounting and finance professionals can step into specialized roles immediately, from accounts payable specialists managing high-volume invoice cycles and vendor payments during year-end close to staff accountants handling reconciliations and preparing financial statements for audits or tax season. Their technical skills and deep understanding of core accounting principles and best practices enable them to assist with critical accounting tasks while maintaining accuracy and compliance under pressure.

Scalable Support

Every organization experiences peaks and valleys. Seasonal hires make it easy to scale your team up or down as needs change and projects evolve, providing the right level of coverage without disrupting long-term operations. This flexibility plays a critical role in maintaining efficiency and meeting deadlines in a fast-paced environment.

Cost-Effective Flexibility

Adding seasonal support gives you access to skilled talent without the long-term overhead of benefits, payroll taxes, or training costs. You pay only for the skills and time you need, making it one of the most practical staffing strategies for busy accounting departments.

Boosted Morale & Accuracy

Bringing in extra help during peak periods relieves pressure on your permanent team, improving focus, accuracy, and retention. It also ensures that every detail—from reconciliations to reporting—is handled with care. Teams perform better when workloads are balanced, and temporary professionals help prevent burnout and maintain consistency when demands peak.

Try-Before-You-Hire

Seasonal placements offer a smart way to evaluate candidates for future full-time roles. The temporary period provides an invaluable window of time to observe technical performance, adaptability, communication skills, and reliability directly on the job before making a permanent job offer. Hiring seasonal workers with experience in a related field or a strong background in accounting also gives you a head start on future hiring, creating a pool of trusted, pre-vetted candidates ready to step confidently into full-time accounting and finance jobs.

Not sure whether your team needs temporary or permanent help? Learn how to choose the right staffing approach for your workload, timeline, and budget.

How to Partner With an Accounting Staffing Agency

Busy seasons can be overwhelming, but the right staffing partner can help you plan ahead, stay flexible, and make these periods far more manageable. Tips for an effective partnership include:

Plan Ahead: Engage your staffing partner early to secure top talent before demand peaks. Many of the most qualified seasonal professionals are booked well in advance.

Define Roles Clearly: Outline responsibilities, required skills, and the duration of each role. What exactly will the person be doing, and what experience do they need? Will the ideal candidate hold a bachelor’s degree in accounting, or is a high-performing professional with a high school diploma acceptable? Are there specific software or tools they should be familiar with? Setting clear expectations helps match the candidates quickly, from accounting clerks and staff accountants to accounts payable specialists and financial analysts.

Leverage Expertise: A specialized staffing agency understands market trends, salary expectations, and firm policies, helping you find professionals with strong organizational skills, excellent analytical skills, and the commitment to keep your budgeting and reporting on track.

Seamless Onboarding: Provide early access to tools, systems, and key team members so seasonal staff can be productive from day one.

Feedback & Post-Season Review: Keep communication open throughout the assignment and review results afterward to refine your strategy for next season. This continuous feedback loop helps strengthen long-term partnerships and ensures smoother transitions in future peak seasons.

Ready to build a stronger accounting team this season?

Frequently Asked Questions

When Should Employers Start Planning for Seasonal Accounting Hires?

Ideally, planning for seasonal hires should begin several months before your busiest period—especially before tax season or year-end close. Early planning allows more time to define each role, from accounts payable specialists to staff accountants, and ensures availability of high-quality candidates. Engaging a staffing agency early also helps you align job descriptions with your business goals, forecast costs accurately, and onboard new team members smoothly when workloads start to rise.

How Can Businesses Accurately Forecast Seasonal Accounting Staffing Needs?

The best way to forecast seasonal accounting needs is to analyze historical workload patterns, such as prior tax season, year-end close, and audit schedules, to identify peak demand periods. Review project timelines, regulatory deadlines, and any planned special projects or system upgrades that could overlap with busy times. From there, assess your existing team’s capacity and plan for additional seasonal accounting professionals to fill gaps. Partnering with a specialized staffing agency can also help you benchmark team sizes against similar organizations and secure talent before demand spikes.

What Are the Most Cost-Effective Ways to Hire Temporary Accounting and Finance Professionals?

Cost-effectiveness starts with timing and planning. Engaging a staffing partner early gives you access to top accounting and finance professionals before the market tightens, and often at better rates. Temporary staff also help control overtime and reduce burnout among your core team, preventing costly turnover. Look for agencies that handle screening, payroll, and compliance administration; this saves both time and overhead. Ultimately, paying for skilled short-term support during busy seasons often costs less than lost productivity or errors from an overextended team.

How Can Temporary Accounting Staff Improve Compliance During Peak Seasons?

During high-volume reporting or filing periods, compliance risks increase as teams rush to meet deadlines. Temporary professionals provide the bandwidth to double-check reconciliations, review financial statements, and verify adherence to accounting principles and tax laws. Their specialized experience reduces the chance of oversights that can lead to audit findings or penalties. Many temporary accounting staff have prior experience in public accounting or regulatory environments, allowing them to maintain accuracy and uphold compliance even when workloads surge.

What Are the Key Skills to Look for in Seasonal Accounting Professionals?

Strong technical and interpersonal skills make all the difference. Look for candidates with strong organizational skills, excellent analytical skills, and a proven ability to manage deadlines in a fast-paced environment. Experience with modern accounting software and understanding of reporting procedures is also essential. Soft skills, such as adaptability, clear communication, and a positive attitude, help ensure seamless integration into your team and steady performance during demanding periods.

Conclusion: Staffing Smarter for Stress-Free Seasons

Seasonal accounting demands don’t have to mean long nights, burned-out teams, or costly errors. With a proactive staffing strategy and the right partner, you can keep workloads balanced, meet deadlines confidently, and maintain accuracy even during your busiest months.

Whether you’re preparing for tax season, year-end close, or a major audit, having the right seasonal talent makes all the difference.

Article Author:

Ashley Meyer

Digital Marketing Strategist

Albany, NY